Introduction

In the realm of construction, particularly in public works projects, the importance of financial security cannot be overstated. With substantial investments on the line, stakeholders must ensure that projects are completed on time, within budget, and to specified quality standards. This is where performance bonds come into play. A performance bond construction serves as a safety net for project owners, providing assurance that contractors will fulfill their contractual obligations. This article delves deep into the significance of performance bonds in public works projects, exploring their functions, benefits, and legal implications.

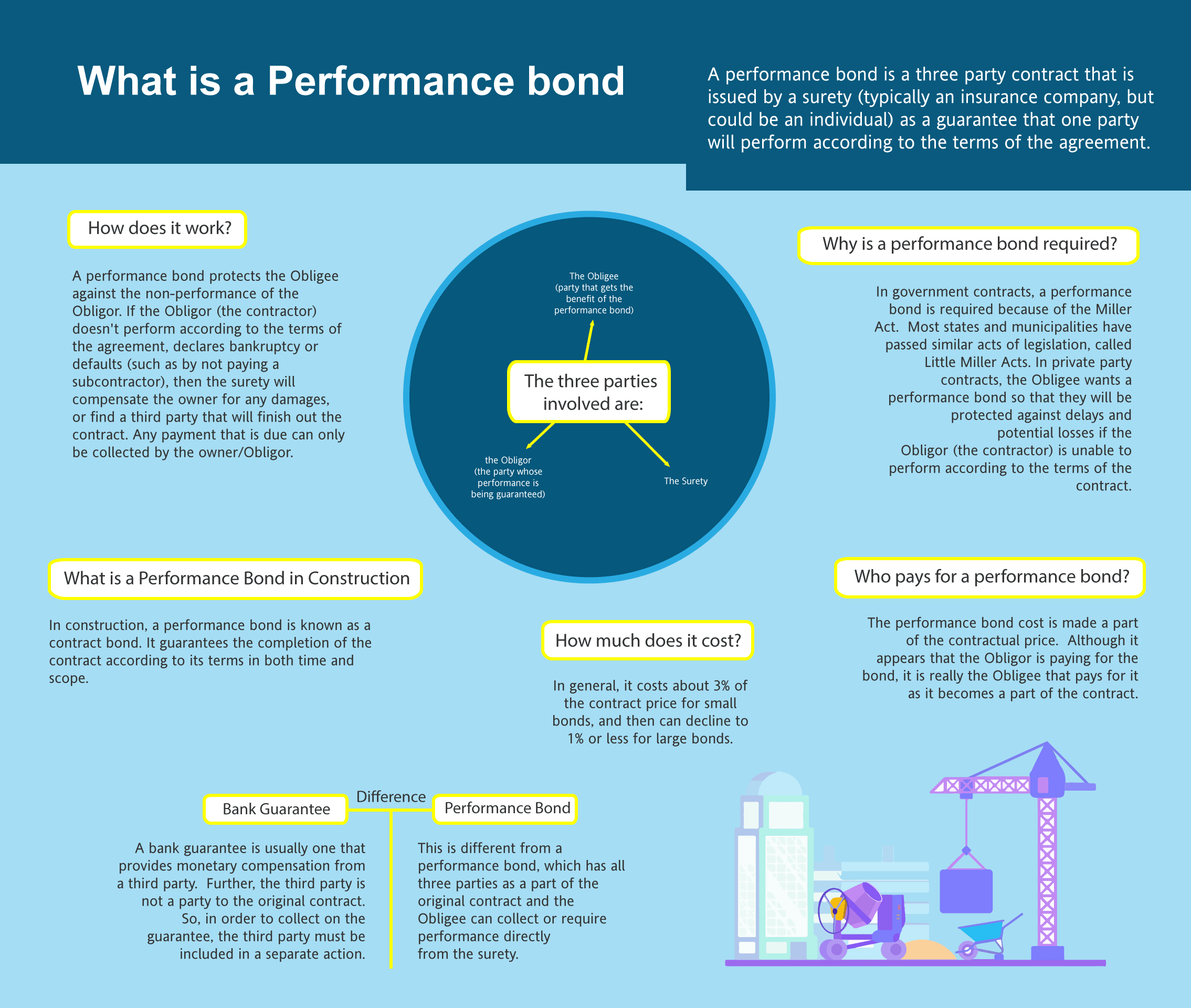

What is a Performance Bond?

Definition and Explanation

A performance bond is a legally binding agreement between three parties: the contractor (the principal), the project owner (the obligee), and a surety company. This bond guarantees that the contractor will execute the project according to the contract's terms. Should the contractor fail to meet these obligations, the surety company steps in to compensate the project owner for any financial losses incurred.

How Does It Work?

The process begins when a contractor bids on a public works project. If awarded the contract, they must obtain a performance bond as part of their agreement. The surety assesses the contractor’s financial stability and capability before issuing the bond. In case of default by the contractor, the surety will cover costs up to the bond amount or find another contractor to complete the work.

Why Are Performance Bonds Essential for Public Works Projects?

Protecting Taxpayer Money

Public works projects are often funded by taxpayer dollars. Consequently, it’s crucial that these funds are used efficiently and responsibly. Performance bonds serve as Swiftbonds a safeguard against mismanagement or failure to deliver on contractual promises.

Click hereEnsuring Timely Completion

Delays in public works projects can lead to increased costs and disruptions in community services. With a performance bond in place, contractors have an added incentive to complete projects on time.

Types of Performance Bonds

Bid Bonds

Bid bonds act as a preliminary guarantee that a contractor will enter into a contract if selected for a project. They provide assurance that bidders are serious about their proposals.

Maintenance Bonds

After completion of construction work, maintenance bonds ensure that any defects or issues arising during a specified period are rectified by the contractor without additional cost to the project owner.

Payment Bonds

Payment bonds guarantee that suppliers and subcontractors will be paid for their contributions to a project, further ensuring smooth operations throughout its duration.

The Legal Framework Surrounding Performance Bonds

Relevant Laws and Regulations

Performance bonds are governed by state laws and regulations which can vary significantly across jurisdictions. Understanding these legal frameworks is crucial for both contractors and project owners.

Contractual Obligations

Both parties involved must clearly outline expectations regarding deliverables, timelines, and payment schedules within contracts linked with performance bonds.

Who Needs Performance Bonds?

Contractors Seeking Public Contracts

Any contractor aiming to secure government contracts must generally obtain performance bonds as part of their bid submissions.

Project Owners Utilizing Public Funds

Government entities utilizing taxpayer money need assurance that contracted work will be completed satisfactorily; thus they require performance bonds from contractors.

Benefits of Performance Bonds in Public Works Projects

Financial Security for Project Owners

Having financial backing ensures owners can recover losses should contractors default or fail to meet specifications.

Enhanced Contractor Credibility

Contractors who consistently provide performance bonds demonstrate reliability and professionalism—qualities highly valued in competitive bidding situations.

Challenges Associated with Performance Bonds

Cost Considerations for Contractors

Obtaining performance bonds can be costly; premiums may vary based on factors such as creditworthiness and project size—a consideration many contractors must navigate carefully.

Complexity in Claims Process

When claims arise due to defaults or disputes over obligations outlined in contracts tied to performance bonds, navigating this complex terrain can pose challenges for all parties involved.

Steps To Secure A Performance Bond

Assess Your Needs

Understand what type of bond you require based on your specific project needs.

Choose A Reputable Surety Company

Research potential surety companies; look for those with strong reputations within your industry.

Prepare Financial Statements

Be ready with documentation showcasing your financial stability—this often includes bank statements and tax returns.

Submit Application

Once you've found an appropriate surety company, submit your application along with required documents.

li5/ol1/hr9hr9/ol2li6li6/li7li7/li8li8/li9li9/li10li10/li11# What happens if I default? A: The surety company steps in either compensating affected parties directly or finding another contractor who can complete remaining work!

Conclusion

In summary, performance bonds play an integral role in ensuring successful public works projects by protecting both taxpayers' investments and fostering accountability among contractors through enhanced credibility measures put forth during bidding processes! While navigating through complexities associated with obtaining such assurances may seem daunting at times—understanding how they function ultimately highlights why they’re essential within our society today!

By reinforcing structures around financial responsibility via these instruments we not only safeguard resources but also enhance trust between stakeholders involved across various sectors influencing our daily lives—from roads we travel upon daily right down through infrastructure supporting vital services—all thanks largely due diligent practices surrounding risk management strategies like those offered through effective use cases surrounding “performance bond construction.”