Introduction

In the complex world of construction, securing a project’s success relies heavily on trust and financial security. As contractors, subcontractors, and project owners engage in various agreements, the need for assurance becomes paramount. This is where performance bonds come into play. They are not merely pieces of paper; they represent a commitment to honor contracts and deliver results. But who provides these bonds? Enter surety companies—the unsung heroes behind the scenes. In this article, we will delve deep into The Relationship Between Performance Bonds and Surety Companies, exploring their significance in the construction industry.

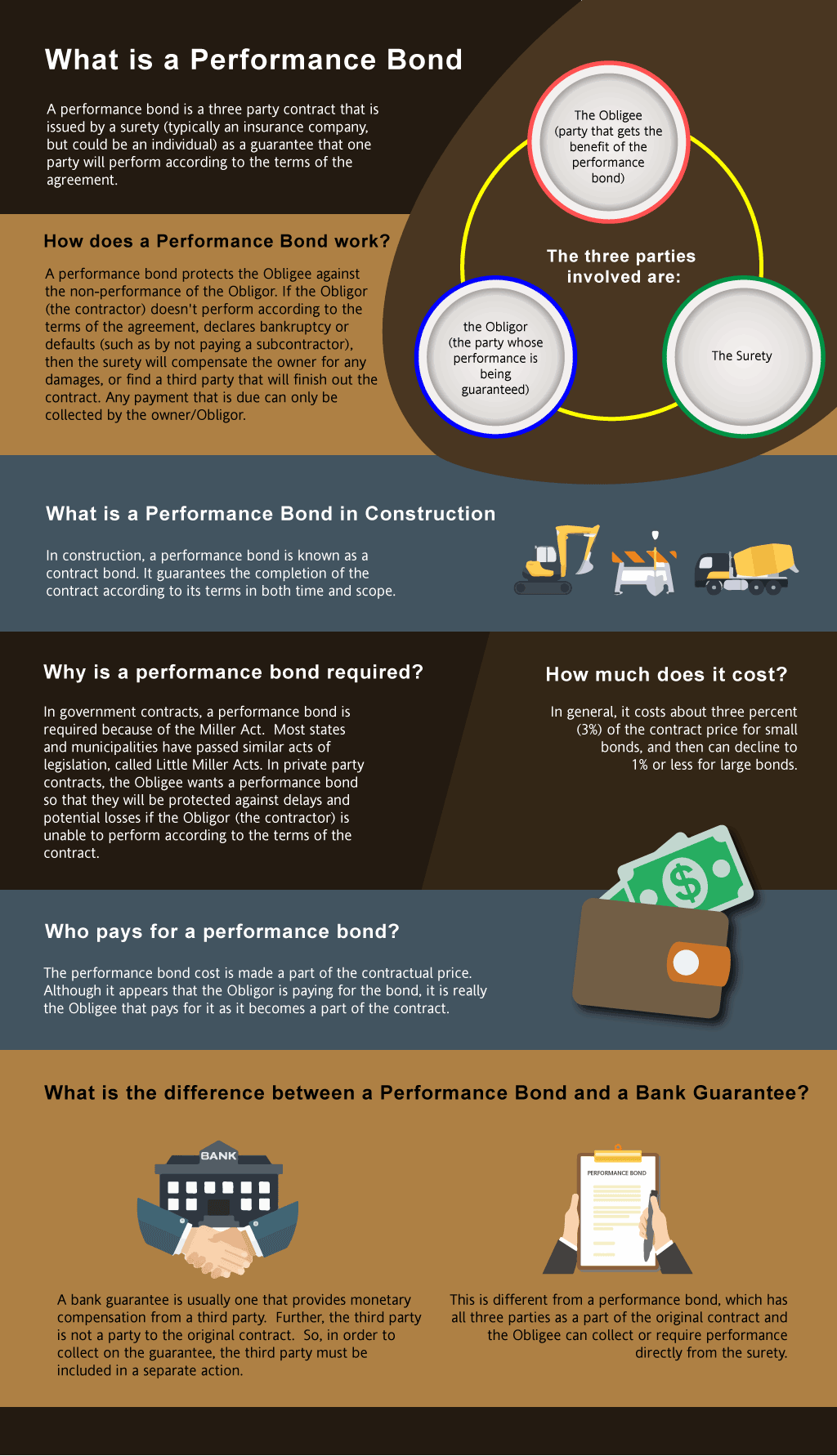

What is a Performance Bond?

Performance bonds are guarantees provided by surety companies to ensure that parties involved in a contract fulfill their obligations. Essentially, it’s an insurance policy for project owners that protects them from contractor default or non-performance.

How Do Performance Bonds Work?

When a contractor bids on a project and wins, they must secure a performance bond as part of their contractual obligations. This bond assures the project owner that if the contractor fails to meet the terms of the agreement—be it due to financial difficulties or poor workmanship—the surety company will step in to cover any losses up to the bond's value.

Types of Performance Bonds

Bid Bonds: These are often required at the bid stage of projects, ensuring that if a contractor wins the bid but later backs out, damages can be recovered.

Maintenance Bonds: These provide assurance that any defects discovered within a specified period after completion will be rectified by the contractor.

Subdivision Bonds: Used primarily in residential projects, these bonds ensure that developers complete necessary improvements like roads or utilities.

Why Are Performance Bonds Important?

Performance bonds protect both parties in a contract:

- For Project Owners: They offer peace of mind knowing there’s financial backing. For Contractors: They enhance credibility and trustworthiness, making it easier to secure projects.

The Role of Surety Companies

Surety companies act as intermediaries between contractors and project owners. They assess risk, provide performance bonds, and ensure compliance with legal requirements.

How Do Surety Companies Assess Risk?

Before issuing a performance bond, surety companies conduct thorough assessments which include:

- Financial Analysis: Evaluating a contractor's financial health through credit scores and financial statements. Experience Review: Analyzing past projects completed by the contractor to gauge reliability. Capacity Assessment: Determining whether the contractor has sufficient resources (manpower, equipment) to complete the project successfully.

The Surety Bond Process

Application Submission: Contractors submit an application along with relevant documentation.

Underwriting: The surety company conducts its assessment based on established criteria.

Bond Issuance: Once approved, the bond is issued; terms are clearly defined between all parties involved.

Benefits of Working with Surety Companies

Some key advantages include:

- Expert Guidance: Sureties often provide valuable insights into contract management and compliance issues. Risk Mitigation: By carefully assessing contractors’ capabilities, risks associated with defaults are minimized.

Understanding Construction Contracts

In construction, contracts outline expectations between stakeholders—project owners, contractors, subcontractors—and serve as foundational documents for performance bonds.

Key Components of Construction Contracts

Scope of Work: Detailed description of what needs to be done.

Timeline: Expected milestones and deadlines.

Payment Terms: How and when payments will be made upon completion or milestone achievement.

Dispute Resolution Procedures: Outlining methods for resolving conflicts if they arise during the execution phase.

Legal Implications of Performance Bonds

Understanding legalities surrounding performance bonds is crucial for both contractors and project owners alike.

Bond Enforcement Laws

Each state may have different laws regarding how performance bonds can be enforced should there be default by contractors:

- In many jurisdictions, owners can make claims against performance bonds without needing to prove fault on behalf of the contractor.

Common Legal Challenges

Misinterpretation of Contract Terms: Discrepancies between stated terms can lead to disputes over bond claims.

Failure to Notify Sureties Promptly: Project owners are typically required to notify sureties immediately upon identifying defaults; delays might jeopardize claims.

The Financial Aspect of Performance Bonds

Performance bonds represent significant financial commitments involving various costs associated with obtaining them.

Cost Factors Influencing Bond Premiums

Several factors influence how much contractors pay for performance bonds:

- Project Size Contractor's Credit Rating Industry Risks Type of Project (public vs private)

Understanding Bond Premiums

Typically expressed as a percentage (usually 1% - 3%) of the total contract value:

| Contract Value | Typical Premium Rate | Total Bond Cost | |----------------|----------------------|----------------------| | $100,000 | 2% | $2,000 | | $500,000 | 1% | $5,000 | | $1 Million | 0.75% | $7,500 |

The Relationship Between Performance Bonds and Surety Companies

In essence, performance bonds cannot exist without surety companies—they form an integral relationship characterized by mutual benefits for all parties involved in construction projects.

Mutual Dependence

Contractors rely on surety companies for bonding capacity while ensuring they remain compliant with regulations governing their operations—creating an interdependency essential for successful project delivery.

Building Trust Through Transparency

Surety companies Have a peek here encourage transparency by requiring comprehensive disclosures from contractors about their finances and past performances—this open communication fosters trust among all stakeholders in construction projects.

Conclusion

The intricate web spun between performance bonds and surety companies forms one crucial component within construction management frameworks today—effectively safeguarding investments while promoting accountability among involved parties!

FAQs About Performance Bonds and Surety Companies

What exactly is a performance bond?- A performance bond is essentially an agreement ensuring that contractors fulfill their contractual obligations; if they fail to do so, sureties compensate affected parties up to agreed limits.

- Typically required by project owners when hiring general contractors or subcontractors on significant projects—especially public ones—that demand additional assurances against defaults!

- Costs depend mainly on several factors—including overall contract value! Usually ranging from around 1% – 3%, though this varies case-to-case depending on assessed risks!

- Yes! There are several types including bid bonds (ensuring bidders follow through), maintenance bonds (covering post-completion repairs) & subdivision bonds (related specifically to residential developments).

- If your contractor defaults on their contractual duties & you’ve secured proper bonding coverage—you can file claims directly against those issued performance guarantees from respective sureties!

- While timelines vary significantly based upon circumstances surrounding each case—it generally takes several weeks or even months before final decisions are reached regarding validity assessments around claims submitted!

This comprehensive overview encapsulates critical aspects surrounding The Relationship Between Performance Bonds and Surety Companies. Understanding these dynamics not only enhances knowledge but also supports informed decision-making within construction management contexts!